Key takeaways:

- Make informed decisions. As highlighted in Reddit discussions, international shipping can be expensive, so choosing the right solution is essential to control costs and ensure reliable service.

- U.S. shipping dominance. According to the Pitney Bowes Shipping Index, the U.S. accounted for 18% of the 159 billion parcels shipped globally in 2021, averaging 56 parcels per person annually.

- Optimize carrier selection. Match shipment types (express, economy, freight) with the right carrier to balance cost and reliability.

- Cut costs strategically. Consolidate shipments, plan ahead, and use tools like Outvio for smarter carrier management and savings.

Finding the best international shipping service can feel like a daunting task. Whether you're trying to cut costs with cheap international shipping options or looking for a reliable courier to get your package safely overseas, the sheer number of choices can be overwhelming.

But don’t worry—you’re in the right place!

In this guide, we’ll unpack everything you need to know about worldwide delivery. You’ll discover tips for shipping boxes internationally, learn how to compare top courier services to determine costs, and explore what makes certain international shipping companies stand out.

If you’re a business, you can start shipping internationally from the U.S. or any other location effortlessly using our shipping software.

What is an international courier service?

International courier services are companies specializing in the transportation of parcels, documents, and goods across national borders. These services are integral to global commerce, enabling businesses to reach customers worldwide and individuals to maintain connections across continents. Unlike standard postal services, they prioritize speed, reliability, and advanced tracking features.

How do you work with an international carrier as an eCommerce business?

You can manage it manually or integrate with carriers. Manually, you handle carriers, international shipping labels, customs forms, and tracking updates, which can be time-consuming.

With integration, orders sync automatically, labels and forms are created instantly, and tracking is automated, saving time and boosting efficiency for international parcel delivery.

Types of international carriers and shipping services

Express carriers

These carriers specialize in fast and reliable international shipping, offering services like real-time tracking, customs clearance, and guaranteed delivery times. They also provide international overnight shipping for extremely urgent deliveries, ensuring parcels reach their destination as quickly as possible.

Economy carriers

Designed for economy shipping, these carriers focus on affordability over speed. Perfect for non-urgent deliveries or lightweight packages, they provide cost-effective solutions while ensuring reliability for worldwide delivery.

Freight forwarders

Experts in handling large-scale international shipments, freight forwarders use air, sea, or land transport to manage bulk goods. They offer eCommerce logistics services such as customs documentation, warehousing, and multi-modal transport, making them ideal for businesses with complex shipping needs.

Regional carriers with global reach

Localized carriers with deep expertise in specific regions, these providers extend their services through global partnerships. They offer competitive rates for shipping boxes internationally while ensuring reliable connections for global delivery.

Specialized carriers

Catering to niche needs, these companies handle sensitive goods like medical supplies, electronics, hazardous materials, or oversized items. With tailored equipment and strict protocols, they ensure safe and efficient international courier services for unique shipping challenges.

Recommend to read

Learn how to professionally manage your eCommerce shipments

Top 15 international shipping companies for delivering packages in 2025

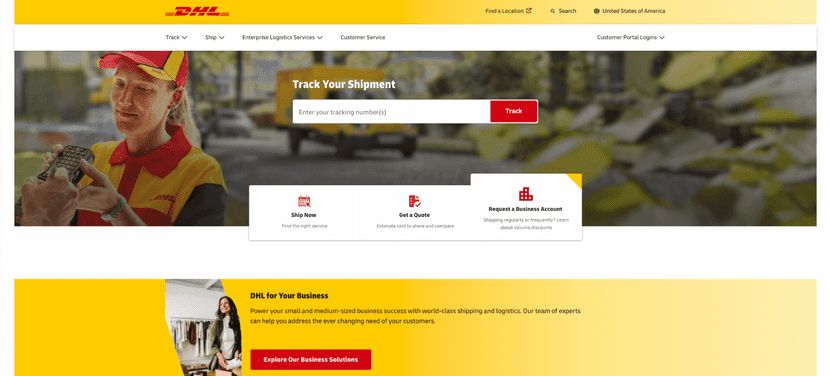

1. DHL Express

DHL Express is an outstanding choice for urgent international shipments. Known for its speed and reliability, the service operates in over 220 countries, offering guaranteed delivery times, making it ideal for those who prioritize punctuality. Its On-Demand Delivery feature allows recipients to adjust delivery preferences, adding flexibility and convenience. Whether it’s a single package or a bulk shipment, DHL ensures fast and efficient deliveries, making it a top pick for both individuals and businesses.

Why recommend it?

- Pioneers in time-sensitive delivery. DHL’s expertise in managing urgent shipments ensures that even critical deliveries meet tight deadlines without disruptions.

- Business-oriented logistics tools. Their advanced shipping tools, like DHL ProView and MyDHL+, provide businesses with enhanced management capabilities for international shipping operations.

- Exceptional handling of specialized cargo. Whether it’s temperature-controlled goods or high-value items, DHL excels at safeguarding sensitive shipments.

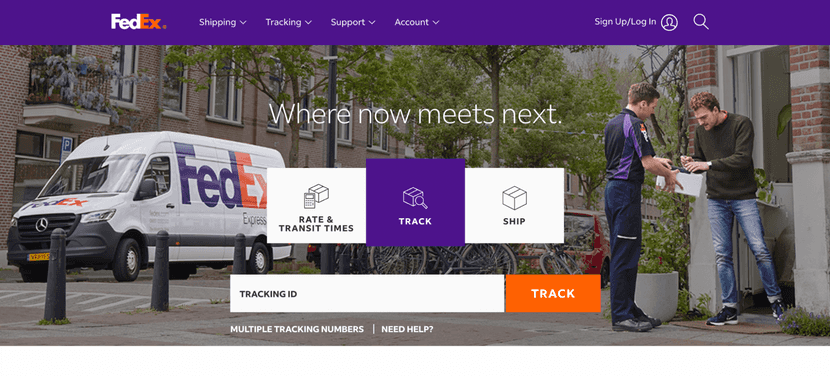

2. FedEx International

FedEx International is a trusted choice for businesses seeking reliable global shipping solutions. Offering options like International Priority for expedited delivery and International Economy for cost-effective shipments, they cater to businesses of all sizes. Known for their robust customs clearance process, FedEx simplifies shipping to complex international markets, making them an excellent partner for companies aiming to expand globally with ease and efficiency.

Why recommend it?

- Customs intelligence for smooth clearance. FedEx’s strong global network reduces customs-related delays, ensuring faster delivery in regulated markets.

- Reliable for high-volume needs. Ideal for businesses shipping large orders frequently, with scalable services that maintain efficiency during peak seasons.

- Industry-specific solutions. From healthcare logistics to retail distribution, FedEx tailors its services to meet specific industry requirements.

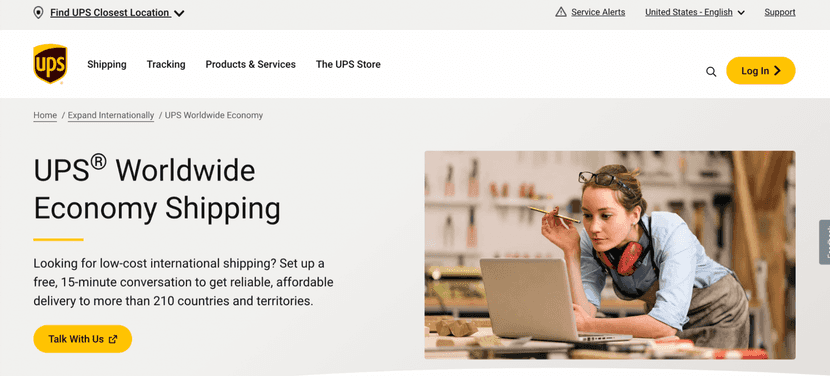

3. UPS Worldwide

UPS offers Worldwide Express, Expedited, and Freight Services, providing a mix of express and economy shipping options. Known for cost-efficient and reliable solutions, it is ideal for heavy goods or high-volume shipments. With a strong global presence, UPS efficiently handles shipments of all sizes and simplifies the process with convenient pick-up points, catering seamlessly to diverse shipping needs.

Why recommend it?

- Versatile delivery solutions. From small packages to freight services, UPS adapts to a range of shipping needs with competitive pricing.

- Eco-friendly initiatives. UPS invests in sustainable practices, including carbon-neutral shipping options for environmentally conscious businesses.

- Convenient pick-up options. Their global network includes thousands of access points, simplifying worldwide parcel delivery for businesses and customers alike.

4. USPS (United States Postal Service)

USPS is a popular choice for affordable international shipping, offering reliability and simplicity. With Priority Mail International, delivery is typically completed within 6–10 business days, while First-Class Package International provides a cost-effective option for lightweight shipments. Designed for individuals and small businesses, USPS simplifies the process with easy-to-use customs forms and flat-rate boxes, making it both accessible and economical.

Why recommend it?

- Affordable solutions for lightweight items. Ideal for international parcel delivery of small packages, with services like First-Class Package International.

- Global reach with flat-rate pricing. Simplifies costs for businesses shipping internationally, especially with their flat-rate boxes.

- Reliable for small businesses. Easy-to-use customs forms and competitive delivery times make USPS a top choice for startups and growing eCommerce brands.

5. Canada Post

Canada Post offers reliable and affordable shipping solutions for Canada-bound deliveries. Xpresspost International ensures fast delivery with tracking for added peace of mind, while Small Packet International is a cost-effective option for lightweight items. With competitive pricing and dependable service, Canada Post is an excellent choice for both individuals and businesses shipping to Canada.

Why recommend it?

- Reliable for North American shipping. Offers seamless parcel delivery between the U.S. and Canada, ideal for businesses operating in both countries.

- Affordable regional services. Their Small Packet International is a budget-friendly option for lightweight packages.

- Focus on customer convenience: Wide access to local drop-off and pick-up points ensures easy parcel delivery international for businesses and individuals.

6. DB Schenker

DB Schenker is a global freight forwarding leader, specializing in efficient logistics for large-volume shipments. Their services include air, ocean, and land transport, catering to businesses needing multimodal solutions. From managing bulk goods to handling complex supply chains, DB Schenker ensures reliable, end-to-end support for timely and secure cargo delivery.

Why recommend it?

- Multimodal logistics solutions. Combines air, ocean, and land transport for seamless high-volume international shipments.

- Customizable supply chain management. Tailored solutions for businesses with complex logistics needs, from warehousing to last-mile delivery.

- Specialized freight handling. Excels in transporting oversized, heavy, or specialized cargo, making it ideal for industries like automotive or manufacturing.

7. TNT Express

TNT specializes in fast and reliable cross-border shipping to Europe, making it ideal for urgent deliveries. With express and freight services, they offer customizable solutions to meet diverse needs. Detailed tracking keeps customers informed every step of the way, ensuring timely and efficient delivery for both businesses and individuals.

Why recommend it?

- Focus on European markets. TNT specializes in fast, reliable cross-border shipping within Europe, making it ideal for regional businesses.

- Customizable delivery options. Their Predict Service allows recipients to adjust delivery preferences, enhancing flexibility and customer satisfaction.

- Efficient express services. Known for its ability to handle urgent shipments with speed and precision, ideal for time-sensitive deliveries.

8. Asendia

Asendia specializes in international logistics for small and medium-sized eCommerce businesses, providing parcel delivery, mail services, and tailored eCommerce solutions. Their strong presence in the European market makes them an excellent partner for U.S. online retailers expanding globally. With cost-effective rates and efficient shipping processes, Asendia simplifies cross-border shipping and supports business growth.

Why recommend it?

- Expertise in eCommerce logistics. Focused on cross-border parcel delivery international, Asendia is tailored for small and medium-sized eCommerce businesses.

- Streamlined returns management. Their solutions simplify the process of handling international returns, ensuring customer satisfaction.

- Strong presence in Europe. Asendia specializes in deliveries to Europe, offering cost-effective and reliable services for U.S. retailers targeting European markets.

9. DPD

DPD offers reliable and cost-effective parcel delivery across Europe and select international destinations. Their Predict Service enhances convenience with one-hour delivery windows and real-time tracking, while Express Delivery ensures rapid and secure transport for time-sensitive shipments. Known for its affordability and efficiency, DPD is a top choice for businesses and individuals handling lightweight parcels.

Why recommend it?

- Exceptional tracking tools. Their Predict Service offers real-time tracking with one-hour delivery windows, enhancing transparency for customers.

- Cost-efficient European deliveries. Tailored for economy parcel shipping, DPD is a reliable choice for businesses shipping frequently within Europe.

- Sustainability initiatives. DPD’s commitment to reducing its carbon footprint makes it a great option for eco-conscious brands.

10. Evri

Evri, formerly Hermes, provides affordable international parcel delivery with a focus on reliability and cost-efficiency. Specializing in lightweight shipments, they are ideal for individuals and eCommerce businesses managing small to medium-sized cross-border deliveries. With competitive rates, Evri ensures budget-friendly solutions without compromising service quality.

Why recommend it?

- Affordable solutions for small businesses. Perfect for eCommerce businesses shipping lightweight parcels, balancing cost and service quality.

- Streamlined returns process. Offers hassle-free returns, which is essential for businesses focused on customer satisfaction.

- Regional focus with global reach. Strong in Europe with growing international capabilities, ensuring dependable economy parcel shipping.

11. Chronopost

Chronopost excels in fast and specialized deliveries across Europe and select international destinations. With Chrono Express International, they handle urgent shipments efficiently, while their Predict Service provides delivery time precision. For temperature-sensitive goods, their temperature-controlled shipping ensures safe transport, making Chronopost an ideal choice for medical and perishable items.

Why recommend it?

- Solutions for regulated goods. Handles pharmaceuticals and other sensitive items with strict compliance to industry regulations.

- Focus on customer experience. Offers delivery rescheduling and tracking features that prioritize recipient satisfaction.

- Cost-effective within Europe. Combines speed and affordability for businesses needing reliable regional parcel delivery international.

12. InPost

InPost offers convenient and innovative parcel delivery solutions, particularly suited for eCommerce businesses in Europe. Their extensive network of automated parcel lockers provides a self-service option, allowing customers to collect or drop off parcels 24/7. With economy delivery and streamlined returns solutions, InPost combines flexibility and efficiency for seamless shipping experiences.

Why recommend it?

- Reduces delivery bottlenecks. Parcel lockers decrease dependency on home deliveries, speeding up logistics during high-demand periods.

- Eco-friendly operations. Their locker-based model reduces carbon emissions compared to traditional delivery methods.

- Enhances customer autonomy. Allows customers to control their pickup or drop-off schedules, improving satisfaction with international delivery services.

13. Aramex

Aramex provides comprehensive logistics and shipping solutions with a strong presence in the Middle East, Asia, and Africa. Offering affordable options for shipping internationally cheap, such as express delivery, freight, and supply chain management, Aramex is ideal for businesses targeting emerging markets. Its emphasis on innovation and tailored services ensures reliable and cost-effective parcel solutions for cross-border shipping companies.

Why recommend it?

- Efficient last-mile delivery. Aramex has developed one of the fastest last-mile delivery systems in emerging markets, crucial for eCommerce success.

- Support for SMEs. Offers budget-friendly logistics plans tailored to small and medium businesses scaling internationally.

- Hybrid delivery models. Combines local couriers with global partners to ensure flexible and efficient delivery in less accessible areas.

14. SF Express

SF Express is a leading logistics provider in Asia, known for its fast and reliable services. Specializing in air freight and cheap shipping overseas, SF Express caters to businesses operating in China and neighboring regions. With its extensive network and tracking capabilities, SF ensures seamless and timely deliveries for businesses needing oversea shipping solutions.

Why recommend it?

- Expertise in customs for Asia. SF Express simplifies cross-border shipping to China and other Asian countries by navigating intricate customs requirements.

- Affordable for eCommerce businesses. Provides competitive rates for small parcels, making it ideal for international parcel shipping of lightweight items.

- Localized customer support. Offers multilingual assistance to bridge communication gaps between businesses and customers in Asia.

15. XPO Logistics

XPO Logistics excels in freight transportation and supply chain management, serving North America and international markets. From road freight to intermodal and last-mile delivery, XPO offers scalable and efficient logistics tailored to diverse business needs. Its expertise ensures dependable solutions for sending parcels internationally and managing complex worldwide shipping operations.

Why recommend it?

- Optimized intermodal transport. Combines road, rail, and sea freight for businesses seeking cost-effective and flexible international shipping services.

- Sustainability-driven logistics. XPO incorporates green initiatives like electric vehicles and carbon-neutral shipping for eco-conscious companies.

- Seamless scalability. Adapts effortlessly to businesses expanding their supply chain to meet global demand.

How to determine which international shipping carrier is best for your business

Build trust with reliable international shipping services

Avoid unhappy customers and lost sales by choosing a carrier with a proven track record of timely and consistent deliveries. Opt for companies with strong logistics networks to ensure your packages arrive on time, regardless of the destination. Trustworthy service is key to building long-term relationships with your customers.

Find the right balance between cost and quality

While saving on shipping costs is appealing, compromising too much on quality can hurt your reputation. Search for carriers that provide a balance between affordability and dependable service, especially for smaller, non-urgent shipments. A well-chosen option will ensure your international parcel delivery meets customer expectations without inflating your budge

Choose between speed and savings for each shipment

For urgent shipments, prioritize express services that deliver quickly, often within a few days. However, for less time-sensitive packages, economy shipping is a great choice, offering reliable delivery at a lower cost. Tailor your approach to match the needs of each shipment while maintaining control over your international shipping costs.

Leverage tracking for a transparent customer experience

A reliable tracking system is more than a convenience—it's a necessity for international shipping. Choose carriers that provide detailed updates, ensuring everyone stays informed throughout the delivery process. Accurate tracking builds trust, especially when managing large shipments or navigating the challenges of cross-border shipping companies.Scalability for growing businesses

Scale easily as your business grows

If you handle bulk shipments or plan to expand globally, prioritize carriers that offer solutions for high-volume shipping and seamless integration with eCommerce platforms. These features help reduce costs, improve efficiency, and support your growth over time.

Choose carriers with reliable customer support

International shipping can involve unexpected challenges like customs delays or misplaced parcels. Work with carriers that offer responsive customer service and proactive solutions. This ensures smoother operations and keeps customers satisfied, even when issues arise.

Opt for specialized shipping when necessary

Unique shipments, such as temperature-sensitive goods or oversized packages, require specialized care. Partner with carriers offering tailored solutions to ensure these items arrive in perfect condition. Choosing the right carrier for your international delivery needs safeguards your reputation and customer satisfaction.

FedEx vs UPS vs DHL, which one is the cheapest service?

In general, DHL is the cheapest option for international shipping services, while UPS is the cheapest option for domestic shipping.

For international shipping, DHL offers a wide range of service options, from express delivery services to standard delivery services. DHL's prices for international shipping are usually lower than those of FedEx or UPS.

For example, a 1-kilogram shipment from Sweden to the United States with DHL Express Saver costs around 50 euros, while a shipment with FedEx International Economy costs around 60 euros and a shipment with UPS Worldwide Expedited costs around 70 euros.

For domestic shipping, UPS is usually the cheapest option for small packages. UPS's prices for small packages are usually lower than those of FedEx.

For example, a 1-kilogram package shipment for 100 kilometers within Sweden with UPS Ground costs around 10 euros, while a shipment with FedEx Ground costs around 15 euros.

However, it is important to note that shipping prices can vary depending on the weight, size of the package, destination, and delivery date. It is recommended to use a shipping calculator to get an accurate quote.

Here is a comparative table of shipping prices for DHL, FedEx, and UPS for international and domestic shipments:

| Service | DHL | FedEx | UPS |

|---|---|---|---|

| International | Cheaper | More Expensive | More Expensive |

| Domestic | More Expensive | Cheaper | Cheaper |

| Small Packages | Cheaper | More Expensive | Cheaper |

| Large Packages | More Expensive | Cheaper | More Expensive |

| Express Delivery | More Expensive | Cheaper | Cheaper |

| Standart Delivery | Cheaper | More Expensive | More Expensive |

This table provides approximate international shipping rates. For more precise pricing, please contact each international shipping company directly.

9 hacks for reduce costs when shipping parcels internationally

1. Use multiple carriers strategically

Different carriers specialize in various regions or services, so diversify your options. For instance, FedEx and UPS are ideal for fast international shipping, while USPS excels in cheap international parcel delivery for lightweight packages.

Using Outvio’s multi-carrier management system, you can connect to several international shipping companies and select the most cost-effective option for each shipment without managing multiple accounts manually.

2. Automate shipping scheduling

Scheduling shipments ahead of time allows you to access lower rates on economy parcel delivery services. Many carriers offer discounts for non-urgent deliveries when scheduled in advance, making it easier to reduce shipping costs without sacrificing reliability. If your shipments aren’t time-sensitive, take full advantage of these options to minimize costs.

3. Consolidate shipments to reduce fees

Combining multiple packages into one shipment is a simple yet effective way to save money. Shipping boxes internationally as a consolidated load reduces handling costs and lowers the overall price per parcel. This approach works especially well for eCommerce businesses managing bulk orders or repeat shipments to the same destination.

4. Match carriers to the right shipment

Align each carrier’s strengths with your shipping needs. DHL and FedEx excel at express deliveries, while USPS and Canada Post offer cheap international parcel services for smaller items.

For heavy or bulk shipments, freight forwarders like DB Schenker provide competitive rates for cross-border shipping services. Outvio’s carrier selection feature allows you to match the right service to your shipment needs, ensuring you don’t overpay for unnecessary extras.

5. Optimize packaging to reduce dimensional weight charges

Dimensional weight can increase shipping costs, particularly for large yet lightweight packages. By using packaging optimization tools, you can evaluate shipment dimensions and choose the most cost-effective packaging size while maintaining product safety.

6. Understand customs fees and taxes

Hidden fees at customs can increase your costs significantly. Research the destination country’s regulations and select a carrier that includes customs clearance services.

For instance, FedEx and DHL provide end-to-end solutions that handle paperwork and duties, such as commercial invoices, ensuring a smoother and cheaper international parcel delivery process.

7. Negotiate rates with carriers

If you’re shipping high volumes, don’t hesitate to negotiate discounted rates with your carriers. Many international courier services offer volume-based pricing or discounts for businesses. Establishing a relationship with your carrier can lead to significant savings over time, especially for worldwide shipping.

8. Look for regional carriers with global partnerships

In some cases, localized carriers can offer lower rates for shipping overseas. Companies like Aramex and SF Express specialize in certain regions but connect to larger networks for global coverage. This combination of local expertise and affordable pricing can help you save money on international package shipping.

9. Monitor and review your shipping strategy regularly

Constantly reviewing your shipping data helps identify new opportunities for savings. With Outvio’s analytics tools, you can monitor shipping performance, costs, and delivery times, allowing you to refine your logistics strategy and maximize efficiency.

What are the most reliable shipping companies? 2025 Comparison

| Name | Star Service | Pricing | Delivery Speed | Reliability | Main Operating Areas |

|---|---|---|---|---|---|

| DHL Express | On-Demand Delivery | High | Express | Very High | Global (220+ countries) |

| UPS Worldwide | Worldwide Express | Moderate | Express/Medium | High | Global, with strong U.S. and European presence |

| USPS | Priority Mail International | Economical | Medium | High | U.S. to Global (small and lightweight parcels) |

| Canada Post | Xpresspost International | Moderate | Medium | High | Canada-focused with U.S. and global connections |

| DB Schenker | Multimodal Freight Solutions | Moderate/High | Medium | Very High | Global, excelling in Europe and freight-heavy routes |

| TNT Express | Predict Service | Moderate | Express | High | Europe and select global destinations |

| Asendia | eCommerce Logistics | Economical | Medium | High | Europe-focused with U.S. integration |

| DPD | Predict Service | Economical | Medium/Express | High | Europe with some global reach |

| Evri | International Parcel Delivery | Economical | Medium | Moderate | Europe, focusing on cross-border deliveries |

| Chronopost | Temperature-Controlled Shipping | Moderate | Express | Very High | Europe, with medical and niche services |

| InPost | Automated Parcel Lockers | Economical | Medium | High | Europe, innovative delivery points |

| Aramex | Last-Mile Delivery Services | Economical | Express | High | Middle East, Asia, Africa |

| SF Express | Air Freight | Moderate | Express | High | Asia (China dominant) with global expansion |

| XPO Logistics | Intermodal Freight | Moderate | Medium | High | North America, Europe, and freight-heavy markets |

| FedEx International | International Priority | High | Express | Very High | Global, strong in North America and Asia |

Outvio: the best solution for international shipping in eCommerce

Outvio simplifies international shipping and returns for your eCommerce by integrating carriers, automating customs documents, and optimizing processes from a single platform. It allows you to compare rates, choose the best option, and offer real-time tracking with customized pages. Ideal for handling large volumes, reducing costs, and ensuring a flawless shipping experience for international parcel delivery.

Additionally, its platform supports international courier services, helps manage worldwide parcel delivery, and optimizes international shipping operations, allowing you to resolve any issues your international customers may have in real-time. This ensures a seamless customer experience and increases their trust in your store.