Having an eCommerce business and selling internationally isn’t a simple task whatsoever, mainly because of bureaucracy. Carrying out customs clearance for your international shipments is a challenge in itself, especially when you don’t have all the needed information. This can slow down and have a negative impact on your international shipments.

Keep reading to learn all you need to know about customs clearance and make every international order an opportunity to make your eCommerce shine.

What is customs clearance?

Customs clearance is a term that refers to the bureaucratic process that comes with shipping between different customs territories.

Customs clearance is a process only necessary for international shipments, meaning orders not outside your borders, but outside your customs borders (regional, national or supranational — like in the case of the European Union).

If the destination of a shipment is in another country or special territory —even inside the same country— with a different tax system, it is considered an export and the package needs to go through a customs office and be accompanied by all the needed documents for correct tariffication.

The customs clearance process happens in the customs office, but the steps and documentation can change depending on the country.

Involved customs clearance agents

Depending on the customs clearance process of every country, there can be more or fewer agents involved in the process. However, as a general rule, you can find:

The owner or holder of goods

It doesn’t have to be the exporter or seller of the products, but they’re in charge of the clearance of customs.

Sometimes, the party responsible for shipping can receive help from a customs agent or a customs representative. This is because of the complexity of certain procedures, especially when you’re not familiar with the market you are shipping to.

The forwarder

This is another agent that is physically present in the customs office, also called a forwarding agent or freight forwarder.

This person is in charge of handling international shipments, preparing and processing customs documentation, and performing tasks related to international shipments. They act as intermediaries between exporters, importers, and carriers.

Carriers or couriers

These are one of the most important links in the supply chain of any eCommerce business. In the case of international shipments, there will be more than one courier involved in the delivery of your products.

The importer or the recipient

Like in the case of the exporter, the importer doesn’t necessarily need to be the recipient of the parcel. In the case of eCommerce exports for a buyer, the importer of the goods is the customer.

As we mentioned before, the export process is very complex and changes depending on the country of origin, transit, and destination, the value of the products, and the chosen type of customs clearance process, etc.

Customs clearance process flow chart

The customs clearance process has several steps that can change or be done at other stage depending on the chosen modality.

Generally speaking, the most common clearance process flow is:

- The arrival of the goods to the customs office

- The inspection of the products

- The examination of the documents

- The payment of taxes and duties, if there are any

- The departure of the goods

These stages don’t necessarily need to happen in this order. For instance, it’s possible to examine the documentation before the arrival of the goods to the customs office.

How long does customs clearance take?

Depending on the country where they are carried out and the modality chosen by both parties, customs clearance can take up from days to weeks or even months. The cost will also depend on the modality, being, faster, generally more expensive.

Customs clearance process types

- General customs clearance. The products and documents are evaluated normally.

- Immediate release, urgent customs clearance or express customs clearance. This is valid for perishable items, products whose purpose is to save lives or treat illnesses, hazardous materials (radioactive, flammable, or explosives), high-value items (such as coins, bills, or precious stones), live animals, or machinery that is essential for the correct functioning of a supply chain.

- Anticipated (pre-arrival) customs clearance. The process can start before the package reaches the customs office. For this, the goods must comply with all the requirements for this modality and the documentation must be complete and correct. These documents must be sent, digitally or physically, to the customs office before the arrival of the goods.

- Deferred clearance. The products can go through the process after the downloading date has passed.

Their names may vary from country to country, but they are the most common modalities you can find to carry out the clearance of your products in a customs office worldwide.

Customs clearance fees

Import duties

It’s used to control the entrance of products from third countries and ensure competitiveness.

Export duties

This tax is counter-productive most of the time, which is why it is not often applied. Its purpose is to increase the profits of the exporting country or create scarcity in other markets, to raise the price.

As a seller, you will probably deal with import tariffs. These can be:

Ad valorem

The government sets a tax percentage that changes depending on the value of the goods.

Specific tariffs

These depend on the quantity or weight of the goods. The government sets a fixed monetary amount for every kilogram or cubic meter of product.

Mixed tariffs and compound tariffs

These combine the previous types, setting a minimum or maximum. For example, 3% with a minimum of €10/kg. If everything goes well, your products will go through clearance and you’ll only need to pay the obligatory taxes.

However, if there’s an error in the documents or tariff classification of the products, you may need to deal with additional custom clearance charges.

Customs clearance documents

Without further ado, these are some of the customs documents and forms you may encounter more frequently:

- Commercial invoice. This document includes vital information for the correct tariffication of the products you are shipping. The commercial invoice can sometimes be replaced by a customs invoice.

- Consular invoice. This invoice is issued by a consulate in the importing country and plays a similar role as the commercial invoice, but has a higher cost.

- Proof of origin. This document is provided by the local authorities —such as a regional chamber of commerce— and determines the country of production of a good. This is an obligatory document for exports from the EU to a third country.

- CN22 and CN23 forms. These forms are obligatory if you want to ship your goods outside the EU by post. Depending on the weight and value of the shipment, you’ll need to fill out one or the other.

- Single Administrative Document (SAD). Frequently referred to as SAD —Form C88 in the UK— this document declares the existence of an operation of importing or exporting. It includes information about the product and eases the process of tariff classification. It’s used in the European Union, Switzerland, Norway, Iceland, Turkey, the Republic of North Macedonia, and Serbia.

- Customs value declaration (DV1 form). This document is usually accompanied by the SAD and is issued by a customs officer or Authorized Economic Operator (AEO). In the DV1 form, you can find the relationship between exporter and importer, —in this case, seller and buyer— the declared value, the costs of the clearance of customs and transportation, as well as the currency conversion used if the purchase was made in a currency different to the euro.

- Packing list (P/L). This list contains the number of packages you’re shipping, their contents, and weight.

- H7 form. For goods under a value of €150, you can fill out an H7 form to speed up the customs clearance process.

Additionally, documents related to other matters such as transportation can be generated: bill of lading, CMR, CIM, air waybill, or documents for multimodal or combined transport, as well as insurance documents or phytosanitary certificates, among others.

These are the customs documents that you may have to deal with more often. In addition to this documentation, the parcels must always include a shipping label.

Conclusions

The customs clearance process can be daunting, specially in the beginning. Nowadays, thanks to globalization and the growth of the eCommerce industry, shipping internationally is an unavoidable task for any online store looking for long-term success.

The first step to ship internationally without shipping issues or delays is to know what the customs clearance process is and what it implies. After this, you'll only need to know what the typical flow is like, how long it will take and which are the fees and charges you will be facing.

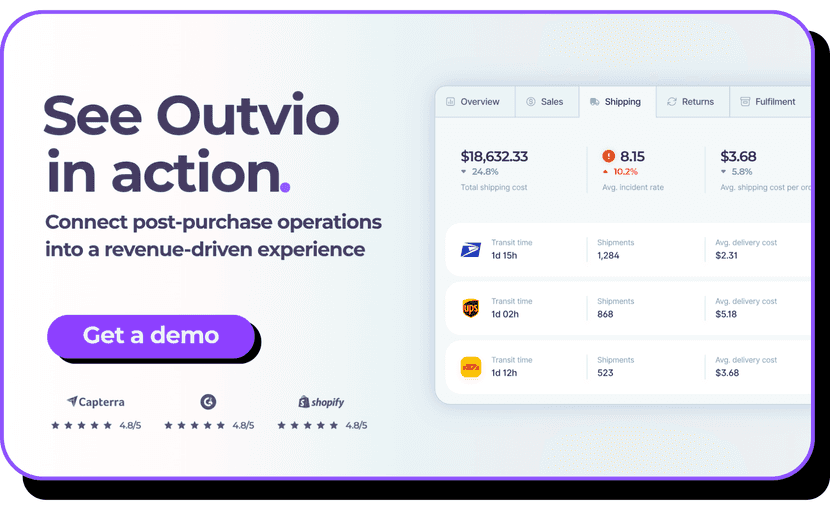

To make sure that your orders arrive timely and with all the customs clearance documents attached, use advanced post-checkout software to streamline your internal operations and offer the best customer experience.

Sign up and start shipping internationally like the champions of eCommerce!