If you are beginning to ship internationally or to customs areas other than the European Union, you have surely come across the EORI number more than once.

If you are unsure about what exactly the EORI number is, what it is for, and how to obtain the EORI number, keep reading.

Additionally, we give you tips to optimize international shipping and returns so that you can minimize the number of shipping issues you experience and make the most of your customer service.

What is the EORI number? What is it used for?

The EORI number (Economic Operators Registration and Identification) registers and identifies you as an economic operator of the European Union.

This number facilitates sales between people and companies within the European Union with a single number, minimizing procedures and speeding them up.

The typical format of the EORI number is the Member State code, followed by the unique code or number in the Member State.

Do I need an EORI number?

The EORI number is necessary if you want to export and/or import to/from a territory in which one of the parties is the customs territory of the European Union and the other party has a different tax system.

The obligation to possess the EORI number falls, therefore, on all those companies or individuals that receive imports or carry out exports between EU Member States and territories other than the EU (in tax matters).

According to current legislation, up to a maximum of five customs operations can be carried out without having an EORI number. After this, the individual or company will need to apply for an EORI number.

Despite this restriction, using an EORI number has a number of advantages compared to managing shipments without an EORI number, so we advise you to get one if you don't already have it.

How do I find the EORI number of my business

The EORI number of a company is very similar to its ID number, you will simply have to add the country code as a prefix. For example: DE 1234567890 8.

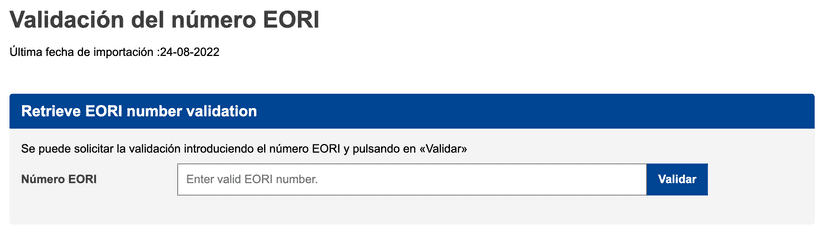

If you want to make sure, you can check the veracity of the EORI number in the database of the European Commission.

How to get an EORI number

Persons or companies established within the customs territory of the EU must apply for their EORI number at the relevant EU institution.

In the case of persons or companies not established within the customs territory of the EU, the application must be submitted to the relevant institution of the country to which they are going to carry out their first export or import.

If you’re unsure, you can consult the corresponding institution.

In any case, there’s a series of data that you must provide to the administration to request your EORI, if this data does not yet appear in the system, such as:

- Valid identification;

- Full name;

- Address or residence;

- VAT identification number(s) assigned by Member States;

- Date of incorporation, in the case of being a legal person; or,

- Date of birth in the case of being a natural person; and,

- VAT identification number(s) assigned by the Member States

EORI number or VAT number

One of the most frequently asked questions regarding the EORI number is whether the EORI number of a company and the VAT number are the same.

The EORI number is created using the intra-community VAT identifier format, but adding the country prefix. Thus, if your VAT number is B87654321, your EORI number will be FRB87654321.

Therefore, although they are not exactly the same, they are very similar. This way of creating the EORI number is very similar in other countries, although in some, additional numbers or letters can be added.

EORI number and tax ID

The tax ID and VAT number are essentially the same. Therefore, the EORI number and the tax ID can be similar, but not exactly the same. Some letters or numbers can be added depending on the country.

EORI number and VAT group

According to the UK government, for EORI purposes, all members of a VAT group are treated as legal entities in their own right. But it is only group members who import or export commercial goods that will require an EORI number.

Conclusion

International operations are becoming more and more frequent in the eCommerce sector.

Now that you know what is an EORI number and the importance of it for international shipping, it's time to automate these shipments with Outvio.

This post-checkout platform automates and streamlines all the processes related to online orders (fulfillment, shipping, tracking, returns...) whether they are national or international.

Additionally, it provides advanced customer support tools and marketing features that help you improve communications with buyers and increase their level of satisfaction with your online store, promoting repeat sales.