Certain documentation is essential for delivering your parcels to the customers. CN22 and CN23 forms are necessary for international shipments outside the EU or to territories with a different tax system than the EU.

In order to prevent delays and unpleasant surprises related to international shipping, the shipper needs to fill out these forms carefully.

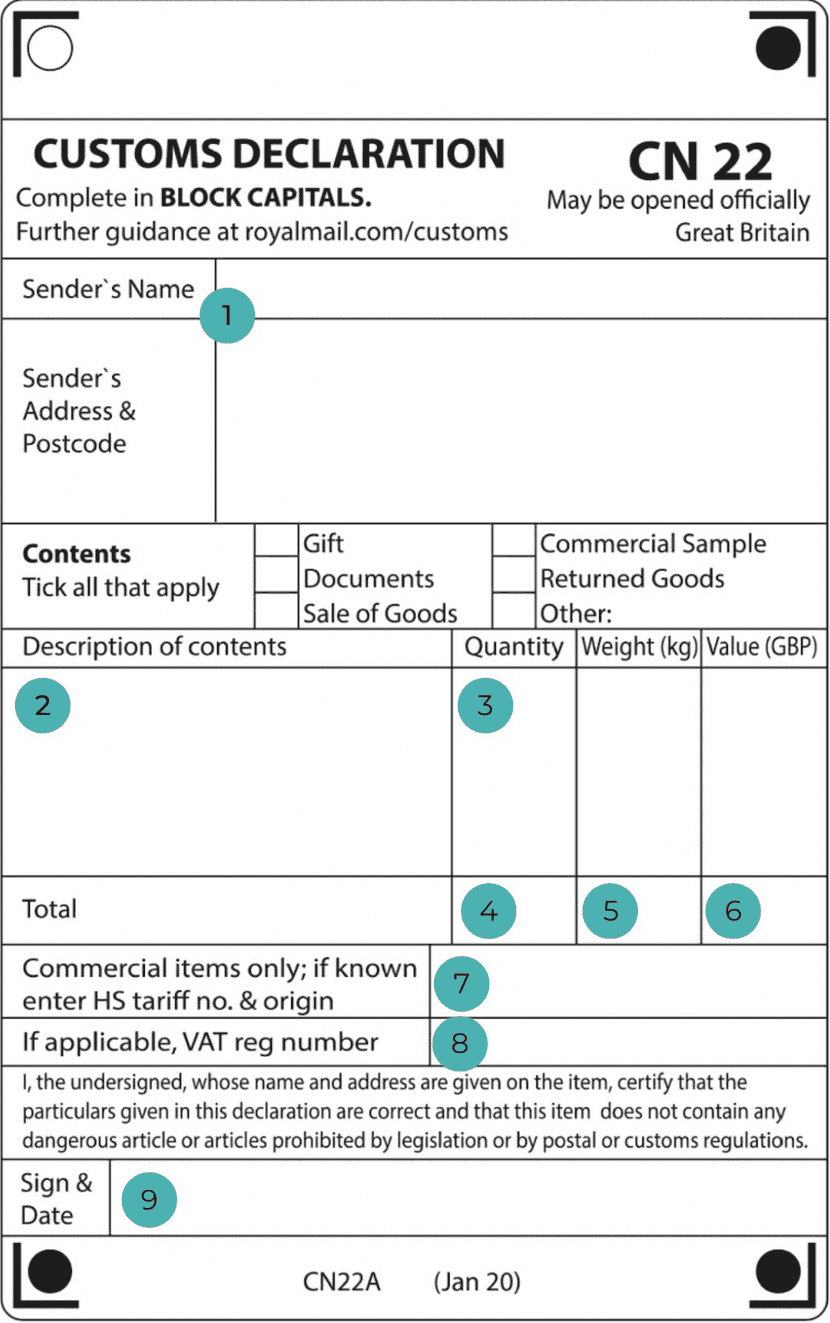

What’s the CN22 form?

The CN22 form, also known as the CN22 label, is an international document used to indicate the value of a shipment, regardless of what it contains (documentation, objects, etc.).

Currently, the CN22 is required for customs worldwide. Its objective is to facilitate the management of international shipments B2B, B2C and C2C. CN22 forms change very little across countries, as it’s part of the international regulation of the Universal Postal Union (UPU).

Example of a customs declaration CN22

Source: Isle of Man Post Office

- Name, address, and postal code of the sender

- Description of the contents. Be precise when specifying the contents to expedite customs clearance

- Quantity, weight, and value of each item in the shipment

- Total number of items in the shipment

- Total weight of the shipment

- Total value of all items in the shipment

- HS Code: The identification code for the applicable customs duties on the goods. For more information, see our HS Code guide for businesses

- VAT or EORI number: This is the number that identifies you as an international shipper. In our EORI number guide, we explain how to obtain your number

- Signature and date

The CN23 form works in a similar way to the CN22 form.

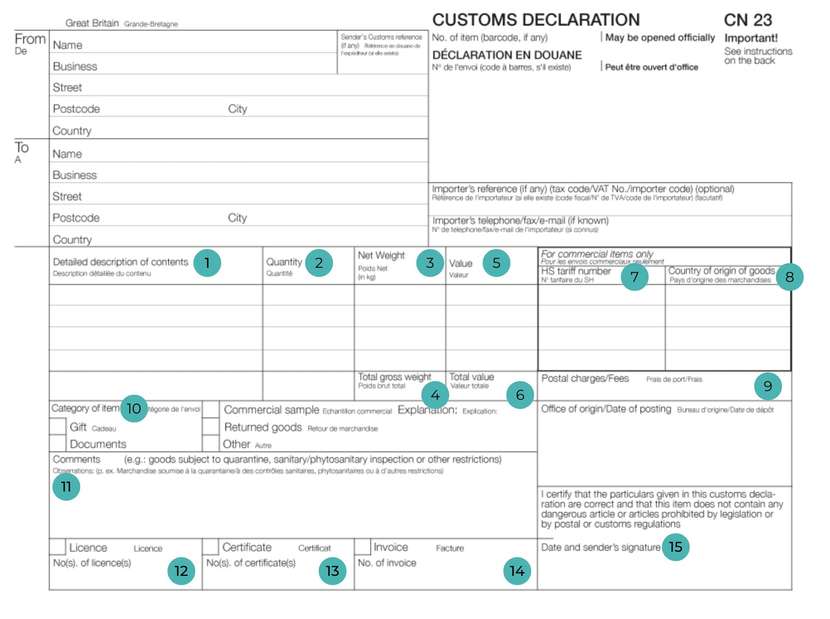

What’s the CN23 form?

The function of the CN23 form is also to identify goods sent to another tariff territory. It can also be referred to as dispatch note, shipment declaration, customs value declaration, or customs declaration.

The CN23 form contains information about the monetary value of the shipment.

Example of a customs declaration CN23

Source: Price Comparison

- Detailed description of each item

- Quantity of each item

- Individual weight of each item

- Total weight of the shipment

- Individual value of each item

- Total value of all items in the order

- HS Code

- Name of the country of origin or manufacture of the products

- Shipping costs or price to be paid for the shipment

- Type of items being shipped

- Added comments

- License. For items that require it

- Certificate. For items that require it

- Invoice. It is common to include the commercial invoice for the items

- Date

It used to be the case that an additional document had to be attached next to the CN23 form. However, the information included in that document is now visible in a CN23 form. This is why shippers now issue a CN23 form in duplicate.

Automating the generation of your international documentation in Outvio's shipping software will prevent you from making mistakes, saving you time, resources, and money.

Differences between CN22 and CN23 forms

Now that you know what the CN22 and CN23 forms are, you may be wondering how they are different and when you should use one or the other. Well, the answer is simple.

The difference between these two forms is the value of the package that they’re attached to.

The obligation to fill in one form or another depends on the value of the shipment you’re going to make. The CN22 is required for orders whose value is less than 300 SDR (around €300).

If a parcel exceeds €350, you'll need to choose the CN23 form. Otherwise, you could face surcharges due to the tariff rate enforced by the package’s destination country. These surcharges will need to be paid by the online store in order to avoid losing a customer, receiving negative reviews or experiencing further delays or hold-ups at the customs office.

When are CN22 and CN23 forms used?

The CN22 and CN23 forms are needed for any international shipment or to a customs area that differs from your own.

Being aware of all the necessary documentation is one of the most difficult aspects of shipping internationally, but, when forms are filled out properly, it will prevent shipping issues. This means better management of your resources, more-efficient operations in your customer service department and satisfied international customers who are willing to buy again.

What do CN22 and CN23 forms look like?

CN22 and CN23 forms are standardized documents on an international level. The language may be different, but the information provided is the same.

These documents can be affixed directly as labels or put inside a transparent envelope attached to the package.

The format of both is quite similar: a single sheet of fillable fields and boxes to be checked.

Filling out this document shouldn’t take you more than a few minutes if you have all the necessary information beforehand. Let’s take a look at what you need.

Where to put cn22/23 on parcel?

The CN22 or CN23 customs declaration form should be securely attached to the outside of your parcel, preferably in a clear plastic pouch or adhesive sleeve. Here are the specifics:

- Location: Place it on the largest flat surface of the parcel, such as the top, near the shipping label but not covering it.

- Visibility: Ensure the form is clearly visible and accessible for customs officials. If you use a plastic sleeve, it should allow the form to be read without removing it.

- Post Office Requirements: Some postal services might require you to hand the form to the postal worker for them to affix it or process it themselves. Check with your local post office if unsure.

Filling out CN22 and CN23 forms

CN22 and CN23 forms must include:

- The sender's contact information (the online store as an exporter)

- The recipient or customer’s information (importer)

- A complete description of the package’s contents

- The nature of the shipment (gift, commercial operation, documents, etc.)

As a seller, you must also provide the HS code of the product/s and the company identification number (VAT number or EORI number).

Wrapping up

As an online store, you’re going to be shipping internationally frequently. If you want to ensure on-time deliveries, always include all customs documents required by the destination.

This article has explained all you should know about the CN22 and CN23 forms. These documents are often prepared by the couriers themselves. However, there may be times when this task will be your responsibility.

Being familiar with the procedures that are carried out in the customs clearance process will considerably improve the logistics related to international shipping and, with it, the level of satisfaction that you provide to your customers.

If everything related to bureaucracy gives you headaches, we recommend that you use a tool like Outvio.

Outvio provides you with all the necessary documentation for international shipping and notifies you when there’s missing information about your products, such as the HS codes.