Cash flow forecasts give organizations the needed visibility to predict future scenarios and handle cash flows in a way that doesn’t put the business at risk. Cash flow plans can be a turn-key tool for the accountability, growth and investment possibilities of the company.

The importance of cash flow forecasting is clear: thanks to past data, cash flow models can be used to predict unfavourable situations as well as to make the most out of positive circumstances. However, cash-flow forecasting comes with some limitations too.

In this article, you’ll find what you can gain and what you should be careful about when you use this metric.

What is a cash flow forecast?

Cash flow forecasts are an estimation of the incoming and outcoming flow of cash for a company in a specific period of time.

Accurate cash flow forecasting can predict the future financial situation of the company, preparing it to overcome possible challenges and make the most out of positive outcomes.

How to calculate your cash flow

Cash flow can only be forecasted —it can’t be 100% accurately calculated due to unexpected events— when having access to organized and updated financial data:

It’s typically done quarterly or yearly, depending on the business objectives, the availability of the information and other factors.

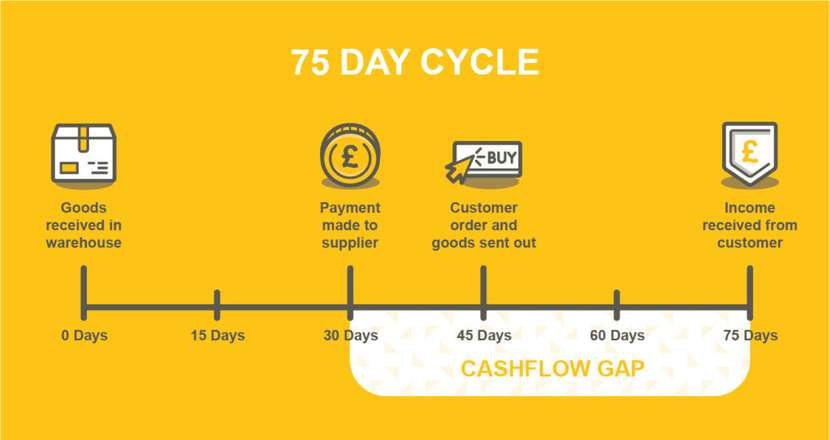

Source: Menzies LLP

Some companies may need a cash flow forecast in order to plan the next quarter’s actions, while others may need it to manage debt payments and pending income on a weekly basis.

Generally speaking, companies would need to:

- Determine the scope/goal of the cash flow forecast

- Determine a period of study

- Choose a forecasting method

- Obtain the data and process it accordingly

Benefits of cash flow forecast

Although the financial and analytical team would need time to carry out a cash flow forecast, there are many advantages of having a forecast of what can most likely happen in the future.

Regardless of how often the data is needed, calculating cash flows as accurately as possible brings some crucial benefits to a business:

- Higher accountability. Cash flow forecasting can shed light on what will happen if X or Z happens, enabling managers to create plan Bs to solve possible issues and create a more reliable company that can be accounted for.

- Predictive growth. It can help prevent bottlenecks and plan future actions such as product developments or what to do if there’s an unexpected increase in demand. Overall, it helps a business to know where it is headed with minimal surprises and a better view of the financial and operational situation.

- More investing opportunities. Looking at weekly, monthly, quarterly and yearly expenses means that both costs and inflows will be easily visible, leading to better cost control and a more attractive business to investors (when the forecast is favourable). It can also prevent insolvency due to cash flow shortages.

If you want to boost the accountability and growth of your retail business, we recommend centralizing all your information in a single hub that tracks and automates all the post-purchase processes and information. Outvio may be just the solution to your operational headaches.

Why is cash flow important? Difference between cash flow and profit

There are some differences between cash flow and profit. Cash flow represents the money that flows in and out of a business throughout a given period, while profits only account for the money after costs are deducted.

Relying on business profit metrics has some advantages, such as the fact that it is real hard data and the fact that the costs are already deducted from them.

However, only cash flow forecasts can determine the company’s long-term financial situation with a higher level of accuracy. For this reason, we suggest that you keep track of both in order to have the best of both metrics.

Limitations of cash flow forecast

Cash flow forecasts unfortunately aren’t 100% accurate. This is because they are an estimation of what can happen in the future according to past data, but unexpected events, such as a change in the economy or consumer behaviour can rapidly change the financial position of a company, regardless of its past performance.

With the right information cash flow forecasts can have a high level of accuracy, although this also depends on the industry and the stability of the market.

When cash flow forecasts are combined with information in real time and historical data, making the right decisions for a business becomes an easier, faster and more reliable solution than going in unprepared.

Numberless tools provide KPIs, but Outvio offers the most complete suite of business metrics to online stores.

Because of the rapidly changing world we live in, yearly cash flow forecasts will rarely be accurate until the end of the year, which is why most companies decide to do them at least quarterly. This way they overcome the most limiting factor of cash flow plans: the fact that they are estimations.

Conclusions

Cash flow forecasts aid businesses when preparing plans of action for both favourable and challenging situations.

Although cash-flow forecasting has its limitations, it’s based on real hard data, which means that, if the industry and market are stable, the accuracy of the forecast will be higher.

To counteract the constraint of the uncertainty, businesses take into account other metrics such as the net profit, costs and other important KPIs.